Many people decide to begin receiving early Social Security retirement benefits. In fact, according to the Social Security Administration, about 72% of retired workers receive benefits prior to their full retirement age. 1 But waiting longer could significantly increase your monthly retirement income, so weigh your options carefully before making a decision.

Timing counts

Your monthly Social Security retirement benefit is based on your lifetime earnings. Your base benefit--the amount you'll receive at full retirement age--is calculated using a formula that takes into account your 35 highest earnings years.

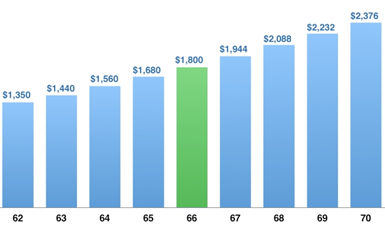

If you file for retirement benefits before reaching full retirement age (66 to 67, depending on your birth year), your benefit will be permanently reduced. For example, at age 62, each benefit check will be 25% to 30% less than it would have been had you waited and claimed your benefit at full retirement age (see table).

Alternatively, if you postpone filing for benefits past your full retirement age, you'll earn delayed retirement credits for each month you wait, up until age 70. Delayed retirement credits will increase the amount you receive by about 8% per year if you were born in 1943 or later.

The chart below shows how a monthly benefit of $1,800 at full retirement age (66) would be affected if claimed as early as age 62 or as late as age 70. This is a hypothetical example used for illustrative purposes only; your benefits and results will vary.

|

Birth year

|

Full retirement age

|

Percentage reduction at age 62

|

|

1943-1954

|

66

|

25%

|

|

1955

|

66 and 2 months

|

25.83%

|

|

1956

|

66 and 4 months

|

26.67%

|

|

1957

|

66 and 6 months

|

27.50%

|

|

1958

|

66 and 8 months

|

28.33%

|

|

1959

|

66 and 10 months

|

29.17%

|

|

1960

or later

|

67

|

30%

|

Early or late?

Should you begin receiving Social Security benefits early, or wait until full retirement age or even longer? If you absolutely need the money right away, your decision is clear-cut; otherwise, there's no ''right" answer. But take time to make an informed, well-reasoned decision. Consider factors such as how much retirement income you'll need, your life expectancy, how your spouse or survivors might be affected, whether you plan to work after you start receiving benefits, and how your income taxes might be affected.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer

(Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Redwood Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union Members.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2016.